2 minute read

Los Angeles

From time to time, we are asked by prospective clients (or their advisors): “Should we engage an M&A advisor who specializes only in our industry?” The notion goes to the question of whether those who work solely with clients in a single vertical industry bring more knowledge, wisdom, or necessary contacts than those who work in multiple industries. It is an intriguing question to us because our firm, now in its 85th year, has a clear specialty, but it’s not a single industry. We build and capture Enterprise Value in private capital gain transactions with high-performing private companies in a variety of industries, but in each case, exclusively for those which are owned and led by Entrepreneur Owner-Managers (EOMs). Owners with skin in the game. Only.

Sure, we used to think having more and more data or information in a specific vertical industry might result in understanding. Over the years—motivated by our clients’ experiences—we have changed our minds. Candidly, we don’t want our creativity to be limited by a lack of wide-ranging experience. We leverage hard won experiences and resourcefulness earned in multiple industries to bring fresh perspectives and inspired solutions to client challenges in any industry. Further, experience suggests that the largest determinant for success is not knowing the most about the client’s industry (after all, they are the experts there), but rather gaining intimate understanding of the EOM’s personal and professional goals, and then translating those into obtaining the best-fit investor (which values the firm highly and increases the probability of sustainability of the business).

The private transaction market is a little like the weather. It is a chaotic, complex, adaptive system. Frequently, a given input does not result in a linear output—you have to be nimble. Luckily for firms like ours, technology has utterly leveled the playing field. Where it used to be true that you had to spend your entire career in a vertical industry just to know who’s who, today we access information and personal contacts on literally every company in every industry in the world at the same time as the largest or most specialized firms do.

For the brain surgeons among us, we know that familiarity decreases the need for brain function. Neuropsychologists show that brain activity decreases substantially when an activity becomes familiar (Schneider & Chein, 2003). Since individuals more easily retrieve observations on companies that are familiar to them, the number of transactions with those familiar companies will be greater. Thus, when advisors specializing in vertical industries repeatedly return to the same industry players because they are more accustomed to them, then will those advisors display a lack of objectivity and possibly unwarranted favoritism towards those same firms? What of confirmation bias? Are there conflicts that result from the repeated exposure to the “same old same old” financial and strategic investors in the industry that impedes their ability to passionately and objectively advocate exclusively in their client’s best interest?

Entrepreneurial success is a bricolage of character strengths of the head and the heart; it is impossible to mathematize. Scar tissue has shown us that weaving together diverse experiences earned from numerous industries unlocks inventive strategies that prove beneficial for Bigelow clients.

When considering engaging the help of an industry expert (in any domain), it might be worth asking, “Do they have twenty years of wide experience—or merely one year’s industry experience repeated twenty times over?”

What I am Reading / Listening to

Excerpt from The Farnam Street Blog post

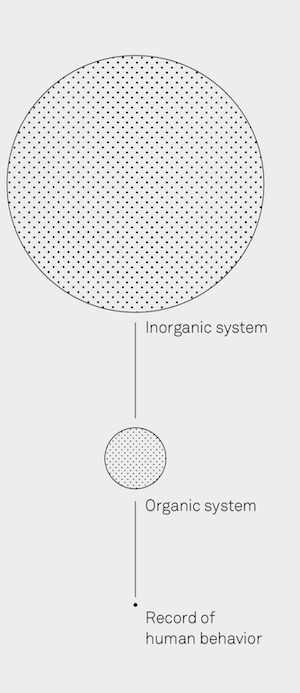

The Three Buckets of Knowledge

“Every statistician knows that a large, relevant sample size is their best friend. What are the three largest, most relevant sample sizes for identifying universal principles? Bucket number one is inorganic systems, which are 13.7 billion years in size. It’s all the laws of math and physics, the entire physical universe. Bucket number two is organic systems, 3.5 billion years of biology on Earth. And bucket number three is human history, you can pick your own number, I picked 20,000 years of recorded human behavior. Those are the three largest sample sizes we can access and the most relevant.” — Peter Kaufmann

The larger and more relevant the sample size, the more reliable the model based on it is. But the key to sample sizes is to look for them not just over space, but over time. You need to reach back into the past as far as you can to contribute to your sample. We have a tendency to think that how the world is, is how it always was. And so we get caught up validating our assumptions from what we find in the here and now. But the continents used to be pushed against each other, dinosaurs walked the planet for millions of years, and we are not the only hominid to evolve. Looking to the past can provide essential context for understanding where we are now.*

*This is an excerpt from the book, The Great Mental Models: General Thinking Concepts.

Entrepreneur Owner-Manager Quote

“There aren’t six right ways to do it [i.e. choose a next majority investor]. It really is just prepare, prepare, prepare.”

- Mike Trigilio, Former CEO of Associated Home Care, current President - Personal Care Division at Amedisys Home Health & Hospice

Energy Creation

Emphasizing a theme we’ve heard other high-performing Entrepreneur Owner-Managers speak to, George Antoniadis describes how he uniquely "gets away" to clear his mind, to help him recharge, refresh, rejuvenate.