Traditional finance theory has largely been developed by non-practitioners with no skin in the game staring into space and “theorizing.” It is based on “utility theory,” the concept that investors act as Homo Economicus ( “Econs”). The assumption is they are utterly rational, each use the same information and spit out the same discounted cash flow valuation models. In that construct, it stands to reason that the distribution of their offers to invest in or acquire an Entrepreneur Owner-Managed business will be represented in a normal distribution (a bell shaped or Gaussian distribution) of offers. In a normal distribution, generally 66% of the number of offers are within one standard deviation of the mean offer. 95% of the number of offers are within two standard deviations of the mean offer.

I’m a practitioner. Look, I have been schooled in the classical theory but it’s quite obviously outdated and broken, so I don’t start there. I start from my actual observations of EOM transactions over a really long period of time. From that, I might attempt to create (or co-create with you) a theme, or a theory which attempts to explain why the actions we observe take place, learn from it, understand probability and correlation, and in some cases possibly even speculate about the holy grail– causation.

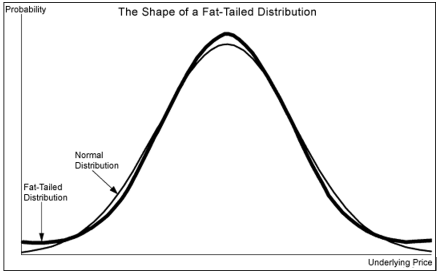

My practical experience informs me that investors in the Private Transaction Market—the best, most sophisticated, highly informed investors in the world—do not act according to classical theory. In fact, a close inspection of the historical distribution of their offers for a large sample of Bigelow’s closed transactions shows that a distribution of actual offers almost always has fat tails (i.e. many offers in the highest and lowest parts of the range). If you fit a curve over the offers, the curve does have a hump in the middle (more offers in the middle) but whew, the tails sure are fat. A fat tail is a property of some probability distributions which exhibit more kurtosis relative to a normal bell curve. You can think of a bell curve as a thin tail distribution. The term fat tail is used in referring to the tendency of many financial offers, price, or return distributions to have more observations in the tails and to be thinner in the midrange than a normal distribution.

Here are a couple of (what may be) interesting insights based on our scar tissue for you. In a look back at 30 recent actual transactions for Bigelow clients, 85 % of the chosen investors we selected (who subsequently successfully closed the transaction) made actual offers at least one standard deviation higher than the mean offer for that company.

Now hear this: 25% of the chosen investors we selected (who subsequently successfully closed the transaction) made actual offers at least two standard deviations higher than the mean offer for that company.

So in the Private Transaction Market, there is usually a fat tailed distribution. While the majority of the number of offers are still near the mean, they are never the winning offers. The winning offers are always way over in the right tail.

Okay. If you are an Entrepreneur Owner-Manager and you want to have a capital gain someday, should this matter to you?

1. In the face of the evidence I just shared with you, if you persist in believing that offers for your Enterprise in a normal thin tail distribution all of (or most of) the time will benefit you, then it doesn’t matter what M & A Advisor you choose, because obviously they have little value to you. You believe offers will simply be within an average range.

2. But if you believe, (and your Expert Advisors believe) as I do, that your Enterprise will capture a capital gain in the Private Transaction Market which is defined by fat tails, then what M & A Advisor you choose matters a lot…because;

3. How the M & A advisor positions the company & proactively seeks investors should attract those in the right tail, which will maximize the EV, not the number of mean offers. Curiously, we often see M & A advisors who are proud of the number of offers they receive near the mean. Why bother?

4. You only get into the fat tails if you proactively “create a market,” resulting in investors having a fear of loss; competitive anxiety. Unless it’s chance.