At the 2011 Bigelow Forum, we explored the relationship between our clients as Principals, and us, the expert advisors, as Agents.

We examined how, as Principals, owner-managers are subject to some well-known behavioral biases and how as Agents, we are not subject to those same biases. Thus, in our cold objectivity, we should be able to advise them well. Our common clients — Entrepreneur Owner-Managers — are Principals in the businesses they own. Accordingly, they are dealing with emotional issues, personal identity concerns and meaning, and consequently are subject to behavioral biases in decision-making. This may lead them to make decisions that if viewed objectively, are not in their own best interest.

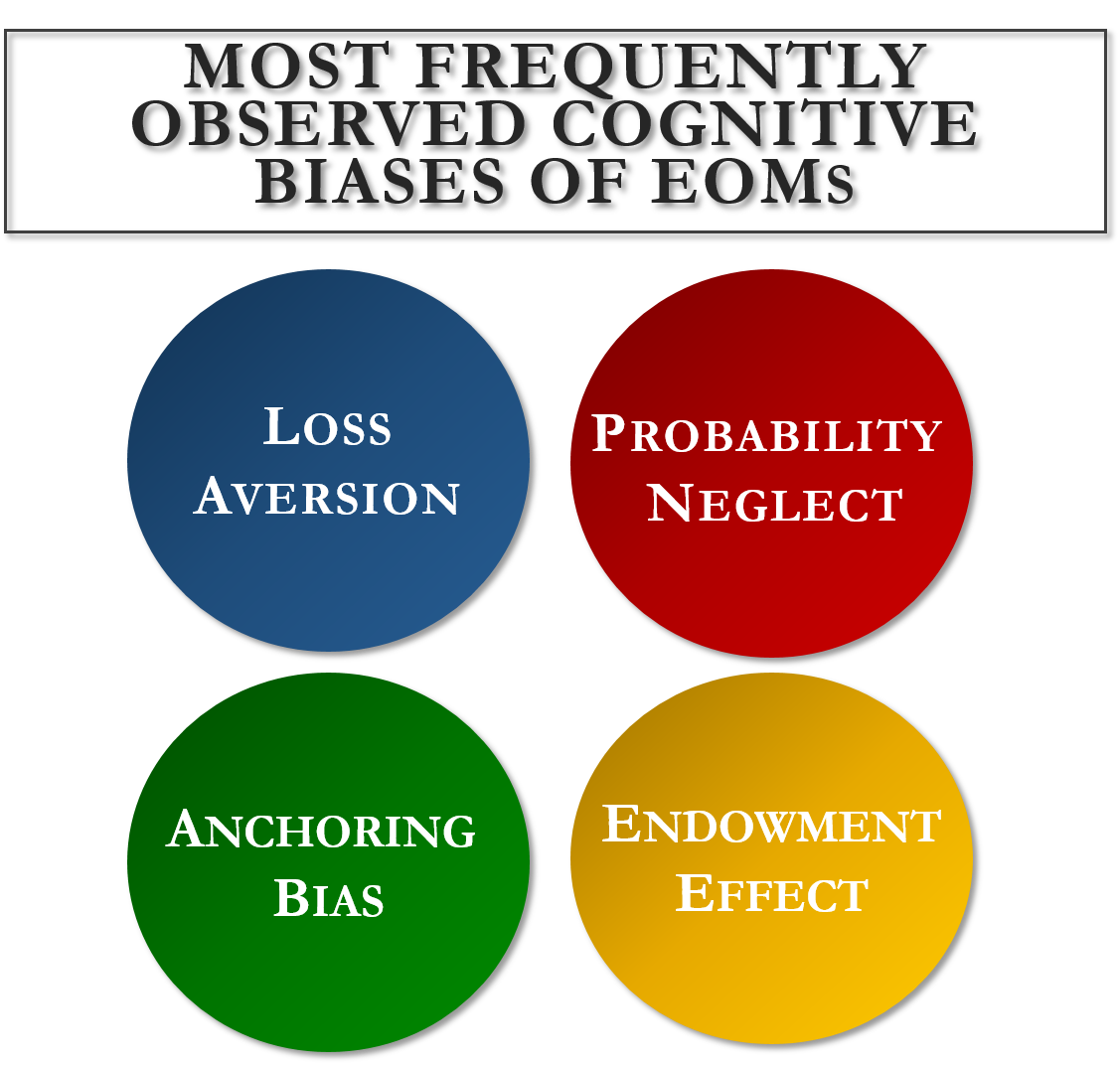

To examine the Principal-Agent relationship, the 2011 Forum kicked off with an orienteering event where attendees participated in four experiment stations—each one highlighting a behavioral bias that was most applicable to the private company capital gain domain.

The next morning, Pete Worrell gave the opening remarks, highlighting the Forum’s origins and purpose. Peter then introduced our guest speaker for the 2011 Forum, Mr. David Brooks, a well-known New York Times OpEd columnist and regular on “The NewsHour with Jim Lehrer” and National Public Radio’s “All Things Considered.” David’s newest book, The Social Animal: The Hidden Sources of Love, Character, and Achievement, illustrates a radically new understanding of human nature and what happens in the unconscious mind. David’s willingness to interact with the audience and provide an in-depth Q&A session created a dynamic dialogue for all attendees.

For the second session with moderator Rob MacLeod, Mr. Richard Zeckhauser, the Frank P. Ramsey Professor of Political Economy, Kennedy School, Harvard University and chair of the Investment Decisions and Behavioral Finance Executive Program at Harvard, presented on the behavioral biases experiments from the previous day’s event.

Entrepreneur Owner-Managers participated in the group and breakout sessions to give candid reflections on behavioral biases they struggled with as Principals during their transactions and how their advisors, as Agents, did — or did not — help them make objective decisions for their own best interests. By discussing and recognizing some of these behavioral biases, the attendees, as Agents, had the opportunity to better advise their Clients, the Principals.

To further our understanding of Entrepreneur Owner-Managers, Bigelow will be conducting original research in conjunction with Harvard University over the next year. The study will examine the risk preferences of entrepreneur owner-managers and their expert advisors. Forum attendees will be invited to participate in the research as part of our ongoing dialogue within this Community of Expert Advisors.