3 minute read

Taos

When Entrepreneur Owner-Managers (EOMs) think about the strategic alternatives available to us to transition our ownership, our context is in what we call the Private Transaction Market. Yet, almost everything you and your advisors know about markets, you learned by studying the Public Equity Markets. Why? It’s where the easily accessible data is.

Have you heard the story about the drunk guy looking for his lost house keys at midnight under the lamppost? “Hey, did you lose your keys over there under the lamppost?” “Nope.” “Well then why you looking over there next to the lamppost?” “It’s where the light is.”

From the Securities Act of 1933 and 1934 to Sarbanes Oxley, and Dodd Frank, virtually all lawmaking about markets is about the Public Capital Market. And, is designed to force the Seller (the company, the issuer) to give more disclosure to the Buyer. As a culture, we are naturally interested in more transparency by the sophisticated issuer to the unsophisticated (often retail) buyers. That’s why we call the Public Market a Buyer-Beware market.

The Private Transaction Market on the other hand, is largely unregulated. There are no required financial disclosures. There is no required transaction transparency. It has no Exchanges, no financial or other disclosure rules, no trading rules, no requirements on knowledge by intermediaries. There are no published market indices, no PE ratios, zip, zero, zilch, nothing. Data is very hard to come by. It's not the Wild, Wild West, but it's close.

In the Private Market there is a built-in asymmetry of risk: i.e. the Sellers (the EOMs) are Principals, have all of the skin in the game, all of the risk of upside and all of the risk of downside capital loss. The Buyers on the other hand (strategic or financial), are usually Agents who may be incentivized on the upside but typically have no downside risk of loss. It’s not their capital. Further, the Agents almost always have more information about the market and the industry, and they have more experience in the market. That’s why we call the Private Transaction Market a Seller-Beware market.

The Public Market is a system with a severe agency problem. It heightens a natural tendency by public company management teams to postpone disclosure of risk, or even hide risk. The trustingly naive retail investor doesn’t notice that a public company management team supposedly paid on profits is not paid on intrinsic Enterprise Value (EV) or sustainable profit, but profit they self-report by quarter. They have a motivation to hide or at the very least extend the time before they report losses, or before they have an eventual blowup (for which they do not have to repay any compensation).

In the private transaction market on the other hand, there is a near perfect symmetry in rewards and penalties: the Entrepreneur Owner-Manager’s Enterprise Value goes up as superior performance validates EV, and down when performance goes down (the captain always goes down with the ship). This means that every EOM is accountable for risk in their enterprise—without exception.

The public market has a normal distribution of returns meaning it always makes sense to diversify, even index. The private market’s returns are highly variable around the average, most of the winners are in the tail of the distribution. One might argue that looking at averages instead of variability actually obscures insight in a fat tailed market like this. Result? It never makes sense to diversify, but rather makes more sense to concentrate your investment (and risk) in the domain where you, the EOM have unique ability.

The public market is where all the data is, so it’s the market we study in trade school: law schools, business schools, finance, accounting, CFA certification, investment theory. Then, many advisors try to apply those public market learnings to the Private Transaction Market.

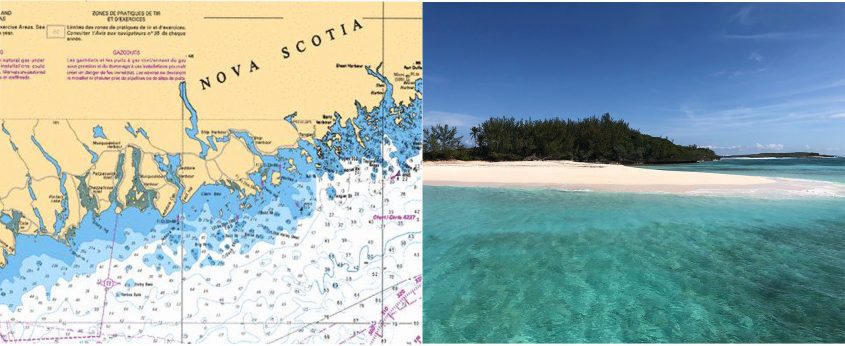

Would you use a navigation chart of Nova Scotia to navigate in the Bahamas? No. Then why apply public market training to navigate the private transaction market? We wouldn’t do it to navigate a vessel, why would you do it to navigate your enterprise which you have worked so hard to guide?

Of Note, References and Further Reading:

Zeckhauser, Richard (1991). Principles and Agents: The Structure of Business. Cambridge, Harvard Business School Press.

Taleb, Nassim, N. (2018). Skin in the Game: Hidden Asymmetries in Daily Life. New York, Random House.

Pressfield, Steven (2002). The War of Art: Break Through the Blocks and Win Your Inner Creative Battles. New York, Black Irish Books.

What I'm Reading / Listening To

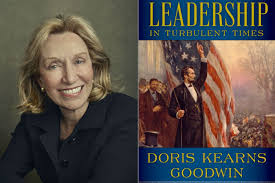

Leadership in Turbulent Times by Doris Kearns Goodwin is her look at Lincoln, Teddy Roosevelt, Franklin Roosevelt, and LBJ through the leadership lens. Goodwin knows these subjects so exceedingly well (having written previous books on each) that her tone here is informed, conversational, easy, almost as if she’s an old friend of theirs. It reaffirmed for me that (no surprise) Teddy continues to be my favorite. Pretty impressive blurbs from people as diverse as Jim Collins and Warren Buffett, too.

Tim Ferris did one of his (really) terrific long-form interview with Doris Kearns Goodwin and the new book on September 11, 2018 here.

Entrepreneur Owner-Manager Quote

“It speaks to you if you listen.”

- Chet Jordan Co-Founder of Digital Architecture, speaking about the challenges of growing the business.

Energy Creation

High performing Entrepreneur Owner-Managers are typically Givers using the definition out of Adam Grant's lexicon on Givers, Matchers, Takers from his book Give and Take (2014). They give, give give. They give of their time, positive energy, discipline, passion, treasure, coaching, unique ability in their domain expertise, leadership, authentic optimism, zest…usually until they are depleted. The key ingredient of sustained success for high performing EOMs is being skilled at identifying and knowing how you get re-freshed, re-juvenated (made young again), re-pleted (the opposite of de-pleted!) when you get worn-out, fatigued, exhausted. It can no doubt be accomplished a number of different ways.

One way is physical. For the past twenty-plus years, Kareen and I have been basically six day a week physical workout people, pretty much regardless of location. For the past several years I have been experimenting with increasingly aggressive breathwork and cold therapy which has been fun and stimulating. I was first introduced to breathwork and cold by the antics of Wim Hof. He’s become increasingly well-known over the past several years for the cognitive and physical positive outcomes that have been achieved by applying some of his thoughts on cold therapy and on aggressive breath work. https://www.wimhofmethod.com. I have made cold plunges and aggressive holotropic breathing a part of my daily workouts. Changes your state.

What do you do to intentionally refresh, or rejuvenate? I am interested in hearing from you.

Blog edited by Amanda Telford.

© 2024 Bigelow LLC. All rights reserved.