2 minute read

Camino Cielo, California

At Bigelow, our boutique Firm’s headquarters are wide open and airy. It is bright, with high ceilings, and a wall of windows looking out on the inner harbor of the charming, antique colonial, Atlantic seaport pocket-city where we headquarter. Ships and tugboats frequently pass by. The heart of our collaborative space is centered around a café. Most days there is music playing from the Sonos, some food or fruit to share on the high-top counter, in season, there are occasionally fresh cut flowers from one of our home gardens. There’s a café style black chalk board where, instead of today’s featured menu, it is usually welcoming a visitor by name, sometimes a little revealed wisdom scribbled across the top.

Generally, there are multiple meetings taking place in the conference rooms around the perimeter, some in person, some using online tools like Zoom or WebEx or whatever. They are customarily spirited, loudly emphatic at times, quietly passionate at other times. On any given day you might find some of us in business dress wearing ties, meeting with a client; in the collaborative studio others in aloha shirts or shorts.

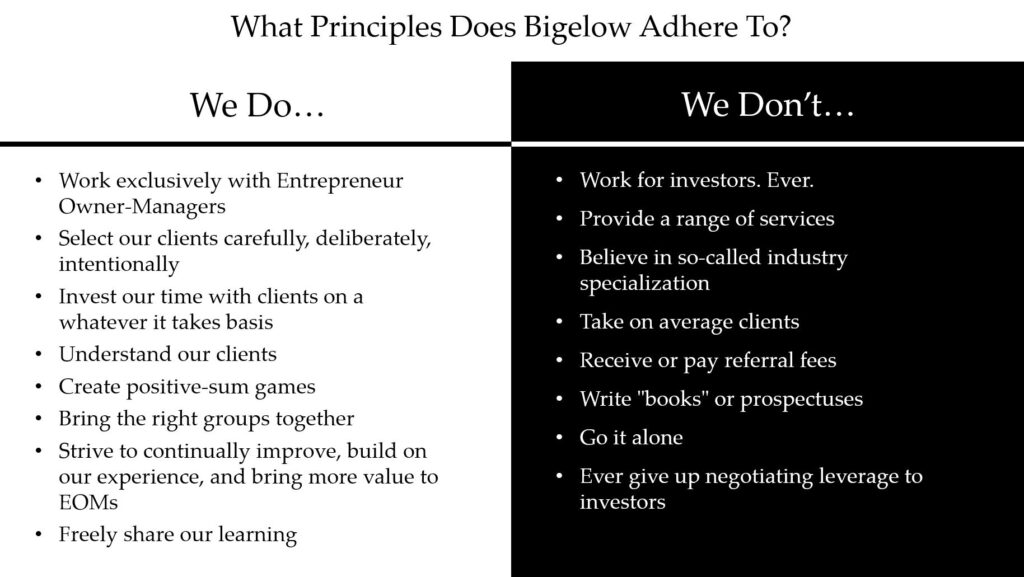

There are some graphics on the walls of the office—some of them intended for Bigelow Nation only, while some are prominently placed for visitors to our office to see. One of them looks like this:

So, at Bigelow we are widely known for our work exclusively for Entrepreneur Owner-Managers (EOMs)—owners of high-performing private businesses. Unlike all the firms with which we compete, Bigelow doesn’t work with the Investor’s side of things. Ever. Why does this surface now?

We’ve noticed a lot of newer generation M&A Advisors are awfully chummy with investors, especially Private Equity Group investors. See, socially, those investor representatives are the same people the M&A advisors are supposed to be negotiating against. Very frequently however, they went to the same exclusive schools, hang out with each other in their free time, go to the same parties, their kids go to the same schools, spouses know each other, and hang out. This new generation imagines themselves as peers or colleagues of the investor community. Most usually, they see their role as to kind of “sell” to the PEG investor.

Shouldn’t be that way. M&A Advisors should be fearlessly advocating for EOMs, and should have a professional, adversarial role with investors. Our job is to ask difficult questions, to think about Culture and Team and Enterprise Value (and all the other values). Not to be their friends. No, there is supposed to be tension there. There is always supposed to be tension there.

We can’t find and pick the best fit investor in the world if we don’t (respectfully) communicate to them that they are in a competitive world where our EOM clients have lots of opportunities and they are going to choose one. The best fit and most highly motivated Investor will validate their interest with the most shared mission, the highest Enterprise Value, and the best terms and conditions, economic and non-economic.

You cannot effectively do that if you are too buddy-buddy with the investor side. But with many advisory firms there is no tension because they are a seamless group who see themselves as being part of the same privileged group of elites that the investors come from. That’s a dirty business. They are conflicted because they are “pitching business” to sellers, buyers, public companies, private companies, Private Equity Groups, strategic buyers, whatever.

Let’s say it bluntly: They. Are. Utterly. Conflicted.

Those M&A advisors are blowing the trust of Entrepreneur Owner-Managers who need us to be fearless, unconflicted advocates. It’s especially offensive when representing passionate EOMs who have typically invested their career or their lives in building their enterprise. Why are we as business owners ourselves and as M&A Advisors even doing this job if it’s not to bring about massive positive change in the lives of EOMs?

At the end of the day, most EOMs only go into the private transaction market once—usually for their sustained legacy, not to mention, the largest single financial transaction of their lives—against investors who have more experience, more information, and more capital (it’s not theirs, but they typically advise it).

Collegially friendly? Sure… but at arm’s length. You won’t find Bigelows sharing any ski weekends with investors or inviting them to dinner at our homes. For us it’s exclusively EOMs Only.

What I am Reading / Listening to

Influence: The Psychology of Persuasion (1984)

By Robert B. Cialdini, Ph.D.

Originally published over 35 years ago, Influence is one of the defining pieces of work on the psychology of persuasion…why people say “yes.” The findings are based on years of rigorous, evidence-based research and a three-year program of study. Cialdini presents six principles of persuasion: reciprocation, consistency, social proof, liking, authority, and scarcity. Cialdini shares that these principles work in a near-automatic response, a “nearly mechanical process by which the power within these weapons can be activated, and the consequent exploitability of this power by anyone who knows how to trigger them.” Influence is a guide to using these principles effectively to amplify your ability to change the behavior of others.

Entrepreneur Owner-Manager Quote

"When you are a CEO, you've got so many M&A firms, different types of people within the M&A field just calling, calling, and calling. I thought it very interesting that I always played offense with them, but Bigelow switched that equation. I had to let you know that I was up to your standards, and it became a give and take—I loved that.”

-Janis Herschkowitz, Former Chief Executive Officer and President of PRL Inc.

© 2024 Bigelow LLC. All rights reserved.