3 minute read

Portsmouth, NH

Almost all Entrepreneur Owner-Managers who own mature, private companies receive an unbelievable number of unsolicited letters, calls, and emails from Private Equity Groups (PEGs) and from business brokers who represent them (or are “fishing” for leads of companies to sell). I scratch my head, because I just cannot believe that seasoned, successful business owners have the time to bother to reply to any cold calls or cold letters, but you must, because PEGs persist in doing it! Frequently, if you do reply or speak with these folks, they will quickly make you a verbal offer of a “range of value” for your business, even with little or no information on your specific firm. Naturally, they always intentionally offer far less than fair market value. This makes sense, right? I mean, these PEGs are monopsonists, aren’t they?

What’s a monopsonist anyway?

Monopsony: A market similar to a monopoly except that large buyers, not sellers, control a large proportion of the market and consistently try to drive prices down. Sometimes referred to as the buyer’s monopoly.

In almost all markets in our world, it is customary that an informed seller faces a group of less informed buyers. Understandable, because the seller owns the asset, knows all about what he is selling, and the buyers usually have less information because they do not own the asset (yet). Typically, the seller is expected to reveal information about details that will affect all buyers’ interest and valuations, and then the (more) informed buyers make offers. We all know the rules of that game, because we all participate in it, whether we are trying to buy a house, a car, a publicly listed security, or a meal. These are “Buyer Beware” markets.

But the Private Transaction Market (PTM), where Owner-Managers realize their capital gain, is a “Seller Beware” market. Generally speaking, as a seasoned successful Entrepreneur Owner-Manager, you are active in the market only once—for the largest single financial transaction of your life. You are genius in your own business domain, but you don’t know the rules of the PTM, what is customary, or what is expected. You have little real hard data about the market. Worse, you may be influenced by the narrative fallacies of country club or cocktail party anecdotes. You are Principals in your own businesses, meaning it is your capital at risk—your skin is in the game—and consequently you are subject to emotionally triggered cognitive biases that can negatively influence your decision making.

The investors side of the PTM (whether PEGs or strategic investors) generally have lots of experience in the market—far, far more than you do—after all, they are in the business of making multiple investments. They always have far more information on market conditions than EOM Sellers, and critically, they are Agents, not Principals. Why critical? Since they are not investing their own capital, they have no skin in the game and thus are not susceptible to those cognitive decision making biases. Instead, they can be coldly objective. All perfectly understandable.

Never before in the post-industrial age has there been an extended time when real (inflation adjusted) interest rates are nearly zero, public equity markets are at all-time planetary highs, and corporate acquirers and PEGs are awash with cash (and seeking private company investments), as they are now. All of these realities favor you, the Entrepreneur Owner-Managers who are trying to build legacy and Enterprise Value. I know you are not objective about this, but in today’s world, what YOU have—a super successful niche private company—is what is scarce and valuable. What the investors have (green, folds, and has George Washington on it) is a relative commodity, and you can basically rent it for the same price from any one of them.

So, you have a significant absolute advantage in the Private Transaction Market. You are expert in your business; your performance validates that. But, PEGS know well that if they can convince you to give away information about your firm—and they know what information will be most helpful to them (and you don’t)—then you are giving away some of your absolute advantage. Most of all, you simply cannot “activate” your absolute advantage in the PTM unless you are dealing with multiple offerors, that is, have “created a market.” In so doing, you level the playing field between EOMs and professional investors by creating a fear of loss and the resulting competitive anxiety among offerors which will bring out fair market value.

Should you take an occasional unsolicited call or even a meeting with a PEG or a strategic investor? Sure, I think you should. Chalk it up to education. Should you sign a Confidentiality Agreement and exchange any formal information? No way. Why would you do that? You are just having a casual conversation and are committed to not giving them any hard information that would require a CA. Instead, do your homework. Prepare a list of questions about what you want to know about them, the businesses they own, the successes or challenges of the management teams that run them. What do they value, why did they call you, why do they find your industry and your business attractive? You can develop a whole portfolio of questions if you have a minute. You might want to ask the (usually young, inexperienced) caller to put a senior partner from their firm on the line. But know this: they are monopsonists, and the Private Transaction Market is a Seller Beware market. You know it is not in their best interest to candidly share their information or experience with you.

That’s why the PEGs and their business brokers are calling you in the first place, right? They are hoping to exploit their experience and information asymmetry. But you know you live in a Seller Beware market. Someday, when you are ready to achieve a capital gain you will carefully create a market of many potential investors, and choose the best fit one. Otherwise, prospective investors will surely take advantage of the impatient or unprepared among us—especially those who don’t bother to “create a market” to attain optimal Enterprise Value.

Note: We feel so strongly about the Seller Beware concept we also created a video on the topic, which you can find here.

What I am Reading / Listening to

“The Invisible Hook: The Law and Economics of Pirate Tolerance”

New York University Journal of Law & Liberty, Vol. 4, Issue 2 (2009), pp 139-171

By Peter T. Leeson

I first learned about Peter Leeson as an economist and through some of his work on the People I Mostly Admire podcast hosted by fellow economist Steve Levitt. Levitt is the co-author with Stephen Dubner of Freakonomics (2005) and the podcast family by that name. Levitt is a smartass, quirky interviewer with an almost childlike quality of sheer curiosity (he will ask anyone literally anything) which is part of what I love about him. I recommend all his books and his podcast series. His interview of Leeson on the podcast People I Mostly Admire is here.

Leeson has a short book with the same name as the article I reference here; I don’t know whether they are the same as I am only referring to the article in the NYU Journal I don’t love the title (an evident pun on Adam Smith’s Invisible Hand), but there are a number of interesting points he makes in the article about pirates, and the pirate world, including the fact that they were a largely democratic group where members elected leaders and shared in the booty. They had skin in the game. That led them to interesting mutual cooperation where even as an illegitimate society they nonetheless behaved remarkably progressively in matters of race, wealth distribution, and leadership.

It’s interesting (at least to me) to contrast the structure of the pirates’ societies on their ships with the structure of say the Royal Navy or the East India Company where on their ships for the most part sailors were salaried workers whereas on the pirate ships, they had a share in the outcome. I’m not in any way suggesting modern day EOMs are pirates, but there are interesting contrasts between the self-governing pirate world and the bureaucratic one of that day that… might rhyme with our world today.

Entrepreneur Owner-Manager Quote

“The Bigelow team brought the needed experience, knowledge, and insight to help me, my management team, and my other advisors get this highly-emotional and complicated event accomplished. They understand the EOM and take the time to do so. Their team worked tirelessly to get us to the goal line. There were so many emotional and important decisions that we could not have done it without them.”

-Irv Robinson, former Chief Executive Officer, Robbie Manufacturing, Inc.

Energy Creation

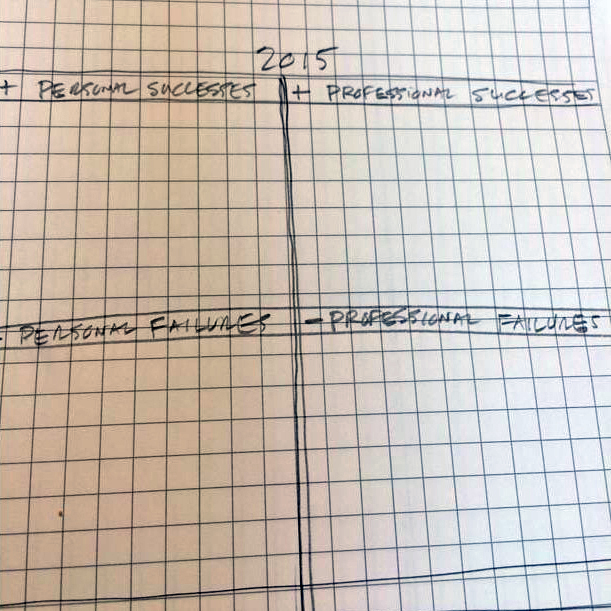

I get massive energy from “fresh starts.” July 1 is the start of a new 90-day quarter, and I am brimming with enthusiasm anticipating everything that’s going to take place in it. Many of you know that I have long followed an annual planning process which I have previously described (strictly “in pencil” because we all know as soon as the plan is on paper life begins ha ha).

My friend Dan Sullivan persuaded me 23 quarters ago to begin thinking about my plans on a quarterly basis instead of an annual one. The quarter being 90 days turns out for me to be more practical to envision, to make quick course corrections, and hold myself strictly accountable to (if you’re so inclined, as I am). It also enables rapid feedback—lets you see rapid wins and also rapid learnings. And you get to push the “reset button” often. Discard immediately what does not work. Change your behavior. Love that.

More meaningful than goal attainment, my quarterly views inspire me to intentionally allocate my positive energy. I know most people allocate their “time.” That’s good. But for me, positive energy is even more valuable to allocate than my calendar since my positive energy is perishable and gets depleted. And I am told, when I am out of positive energy it’s no good for me or anyone around me. And the opposite is also true. So, I look at the next 90 days and very purposefully allocate my positive energy and times of rejuvenation. It’s not perfect, but for me it’s better to attempt to allocate it than not.

I “get” that we live in the present, and there’s more luck and randomness in the future than we can believe (in fact I welcome it). Nonetheless, intention governs attention, and attention (or focus) is surely one of the greatest contributors to achievement/attaining your goals. Looking at my planning for previous quarters, I can see how my intention/attention/focus has had significant positive impact in a number of domains. I know that this next quarter will be totally unlike the last one personally and professionally—and I can’t wait.

© 2024 Bigelow LLC. All rights reserved.