We have the incredible fun of meeting, listening to, and working closely with hundreds of the most successful, seasoned, Entrepreneur Owner-Managers across North America. But you know, there are just not that many really useful generalizations we can make about them, or their organizations (in the aggregate), that are precise or immediately valuable. They are for the most part, wildly different, unique, independent thinking individuals leading organizations with superior performance dominating niches—mostly very different from one another.

What we can say is most seasoned, successful Entrepreneur Owner-Managers spend 95% of their time thinking as managers—5% as owners. Makes sense. Owners have different motivations than managers. We want managers to work “in” the business, to make lots of smaller day-to-day decisions, and mostly get them right. Owners on the other hand, we want working “on” the business, to act as leaders, as stewards for the long-term success of the enterprise. As owners we typically make fewer, but higher impact decisions, which highly influence future Enterprise Value (EV). So think with me for the next 90 seconds as an owner.

Selectively raising prices to reflect the value you bring to your customers, clients, constituencies, —and align your business model with your strategy— is an owner decision.

Most—almost all—of the EOM organizations we meet are pursuing a strategy of differentiation within their addressable market niche (as opposed to trying to be the low-cost low-priced producer). This mostly makes sense as they are usually in positions where they can provide more value through differentiation. Few of them have means, or the scale, to achieve the lowest cost per unit required of massive commodity providers (of anything).

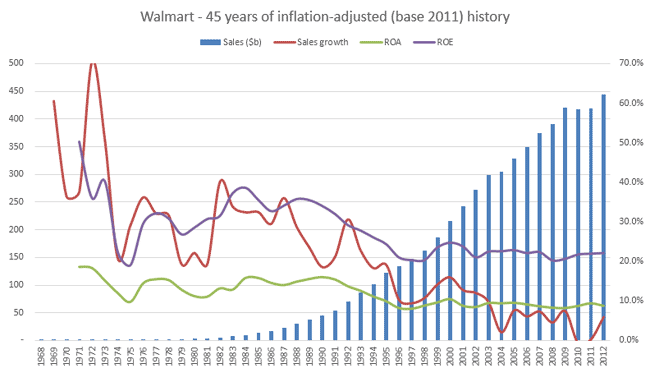

Yet, there is no escaping the reality of a mass popular culture where the motto of the biggest company in the world is… “Everyday Low Prices”. It’s no overstatement to say most consumers today are obsessed with getting low prices, regularly sacrificing quality or discerning service. The proof is in Wal-Mart’s sales; consumers vote with their feet and their dollars. And Wal-Mart’s scale (the largest company in the world by revenue—$600 billion est. 2017) allows them to have the best logistics network in retail (maybe in the world), the most powerful, systematic, cost-cutting (read: pounding the table) vendor relationships, and by far the most power politically to continue to hire the least expensive available labor.

Whether we like them or don’t like them, Wal-Mart is a great example of a company whose business model is completely aligned with their business strategy. They focus above all else on getting the lowest cost per unit of any firm in the world, so that at a given (low) price, they achieve a higher margin than anyone else. This alignment has translated into competitive advantage, resulting in a company that has the highest sales of any in the world.

In our private Entrepreneur Owner-Manager world, on the other hand, unless we are selling to one of only a few industry segments (like WMT), the customer’s buying decision is usually not merely about economics. If we pursue a high-service, high-quality, high-cost, high-price strategy, then we have to deliver. Our organization’s model has to be completely aligned with that strategy and…we have to execute. We create the unique client/customer experience that merits that higher price premium.

So if there could be one piece of advice we could give to almost every one of our friends/clients, it is this: “Selectively raise your prices”. As managers, we may not fully appreciate the value that we are bringing to our customers/clients. We are fearful of criticism, customer objection, or failure. As owners, we are not objective, and we are subject to all sorts of cognitive biases that subtlety and negatively affect our optimal decision making. The result is we are too slow to increase prices. Yet it is those price increases which allow us the cash flow and superior financial performance to invest in the long-term success of the enterprise. The cash flow to feed our investment in higher wages, working capital, capital expenditures, and return on capital to shareholders. You don’t need to be just about to go out and acquire a new majority investor, to want to earn superior results and appreciated EV.

I am reminded of the analogy of the field mouse and the lion. A lion is fully capable of capturing, killing, and eating a field mouse. But it turns out that the energy required to do so, exceeds the caloric content of the mouse itself. So, a lion that spent its day hunting and eating field mice would slowly starve to death. A lion can live a long and happy life on a diet of antelope, however. The distinction is important, right? Are you investing your time and depleting your positive energy catching field mice? In the short term, it may give you a nice warm rewarding feeling. But in the long run? You starve to death.

Look, what’s the worst that could happen if you experiment with selectively raising prices? (We are not talking about “taking advantage” or “gouging” here, that’s the worst kind of short-term game: idiocy). We are talking about earning a fair return on sales which validates that your customers really appreciate what you are delivering, and is of tangible value to them. What happens if you raise prices on your most demanded product or service by say 6-12%? What about the least demanded? How about on the product or service that “crowds your capacity” the most? If one of the greatest threats to your entrepreneurial success is you or your organization getting distracted by low-value “busyness”, then could more leveraged pricing allow you to simplify and let the market help you decide what to discard?

I’d like to say, “Don’t worry, we understand if you’re too busy as a manager to think about these important owner decisions” …but actually we don’t understand. Are you interested in long term—really long term—sustained success for all of the invested constituencies of your enterprise? Are you willing to do the things necessary to earn the needed economic surplus to protect the team that you recruited, hired, and trained? Do you want to build and leave a positive legacy, and oh by the way, have an opportunity for a capital gain event someday?

It’s exclusively entrepreneurs’ generative ideas and action, not capital, and not bureaucrats, that enrich the whole world in every way. In the domain we live in, superior financial performance is one way that any coldly objective outsider validates that the experience you are delivering to your customers, or clients, is really valued by them. Try this owner’s experiment: selectively raise your prices to increase alignment between your strategy and your business model.

Postscript/ No one can predict the future. Yet every conscious human today knows or senses that Amazon’s domination of e-commerce is quickly transitioning over to the brick and mortar retail industry, and is gaining incredible momentum over Wal-Mart’s traditional strategy. Can Amazon achieve low cost same day delivery in markets which heretofore have been dominated by brick and mortar stores? If so, they really do have a chance to disrupt the big box retailers. Why would any working parent stop at Wal-Mart on the way home from work to pick up a new case of Pampers if they can order from their smartphone at noon, and have the Pampers waiting for them when they get home? When Amazon (and other innovative e-tailers) become a real threat to traditional retailing, the strong historic alignment between Wal-Mart’s business and operating model will erode. So, Wal-Mart is a great example of an industry disruptor that had strong alignment between its strategy and operating model—being disrupted—a company that now has a conflict between its strategy and model, mainly due to innovative entrepreneurs and e-commerce businesses. The economist and thinker Joseph Schumpeter called this “Creative Destruction”. And of note, without a doubt it’s always the consumer who benefits.

Of Note: References and Further Reading:

- Diamandis, P. H., & Kotler, S. (2016). Bold: how to go big, achieve success, and impact the world. New York: Simon & Schuster Paperbacks.

- Ericsson, K. A. (2016). Peak: secrets from the new science of expertise. London: The Bodley Head.

- Fishman, C. (2011). The Wal-Mart effect: how the world’s most powerful company really works – and how it’s transforming the American economy. New York: Penguin Books.

- Hirschman, A. O. (2007). Exit, voice, and loyalty: responses to decline in firms, organizations, and states. Cambridge, MA: Harvard Univ. Press.

- Kelly, K. (2016). The inevitable: understanding the 12 technological forces that will shape our future. NY, NY: Viking.

- Lewis, M. (2017). The undoing project: a friendship that changed our minds. New York: W.W. Norton & Company.

- List of largest companies by revenue. (2017, April 23). In Wikipedia, The Free Encyclopedia. Retrieved 16:03, April 24, 2017, from https://en.wikipedia.org/w/index.php?title=List_of_largest_companies_by_revenue&oldi d=776790767

- McCloskey, D. N. (2016). Bourgeois equality: how ideas, not capital or institutions, enriched the world. Chicago: The University of Chicago Press.-09uytrioee

- Ortega, B. (2000). In Sam we trust: the untold story of Sam Walton and Wal-Mart, the world’s most powerful retailer. New York: Three Rivers Press.

- Rose, T. (2016). The end of average: how we succeed in a world that values sameness. New York: HarperOne.

- Russell, B. (2013). The conquest of happiness. New York: Liveright Publishing Corporation.

- Seligman, M. E., Railton, P., Baumeister, R. F., & Sripada, C. (2016). Homo prospectus. Oxford: Oxford University Press.

- Sullivan, D. (2016). The Self-Managing Company: How to build a company that manages iteslf to growth. (A Stragegic Coach EBook Series).

- Taleb, N. N. (2014). Antifragile: things that gain from disorder. New York: Random House Trade Paperbacks.

- Walmart graph retrieved from: http://studentofvalue.com/walmart-1968-2012/