2 minute read

Toronto

Does the definition of mentor require that the mentor knows they are a mentor to the mentee? I am not sure if the generally accepted definition of “mentor” requires that you know the person and that they know that they are your mentor, but for the purpose of this essay, I am going to stipulate that they don’t have to.

I have had incredibly positive and encouraging mentors in my life for which I am grateful every day. They might include for example, Don Sutton, Henry Powers, George S. Patton, Jack Aubrey, Tom Feeley, Brooks Whitehouse, Richard Kimball, Steve Watson, Dan Sullivan, Marty Seligman, Chris Bouzaid, Jack Darrell, Naval Ravikant, and many others. But professionally—supremely, for over forty years—it has been Danny Kahneman.

I first discovered Daniel Kahneman (and Amos Tversky) in 1979 or 1980 when I was earning an MBA at Babson. I was a Graduate Teaching Assistant in the Economics Department thanks to the generosity of the then Chair of the Department, Bill Casey. They had me doing the usual TA scut work involving tutoring undergrads (including for a couple of semesters, Akio Toyoda, but that’s a complete separate story on its own). One afternoon, Bill Casey slid the latest copy of the economics journal Econometrica across his desk to me and suggested I read the Kahneman & Tversky piece and give him my thoughts.

Amos Tversky and Daniel Kahneman in the late 1970s, photographed in the garden of Tversky’s house in Stanford, California.

Amos Tversky and Daniel Kahneman in the late 1970s, photographed in the garden of Tversky’s house in Stanford, California.

I read the piece, made some notes in the margins, then read it again. And again more than once. It sat in a pile beside my desk, and I picked it up from time to time and made more yellow highlights. It got to the point where it was almost all yellow highlights and scribbled pencil. I told Casey I thought the paper was: a) poorly titled (what does Prospect Theory connote anyway?); and b) it’s observations and conclusions utterly flew in the face of classical economic theory. In classical economics, individuals have always been thought of as “Homo Economicus” who would make decisions based upon maximizing utility in their coldly objective rational self-interest. Kahneman & Tversky conducted a series of hard science experiments which suggested that many of us are susceptible to cognitive decision-making errors, where we use shortcut heuristics, get confused, and frequently make decisions that are not in our own rational self-interest. Okay, cute, I thought. Maybe there are some people like that, but not successful ones, and definitely not me!

But there were some thought-provoking concepts. Concepts that, once I had ten years’ experience of working with Entrepreneur Owner-Managers (EOMs) under my belt, I felt we should re-visit. I saw high-performing EOMs make errors from time to time. At first, I thought they were just anomalies. Then, I began to see that the errors (in our domain of entrepreneurial risk, skin in the game) were similar, systematic, and repeated. In fact, I began to think of them as predictable. I would ask myself, why are these super smart people sometimes so stupid about risky decisions?

For example: Ask people if they would take a risk with an 80% chance of success, and most say yes, they would. Asked a different way, if they’d take the same risk with a 20% chance of failure, and most say no. What? Want to test it? Try this with some friends.

Some of Kahneman & Tversky’s work by now (45 years later) is so widely accepted, it may seem to some readers to be almost common sense. But it veered so widely from classical economic theory that it was nothing short of shattering for how we thought about decision-making. I read everything I could get my hands on written by Kahneman and some of his colleagues (notably Dick Thaler who was his prodigy and who himself received the Nobel Prize in Economics in 2017). Loved his book Thinking Fast & Slow (2011). Didn’t love the next book which he wrote with Cass Sunstein called Noise (2021) (as in background noise versus signal).

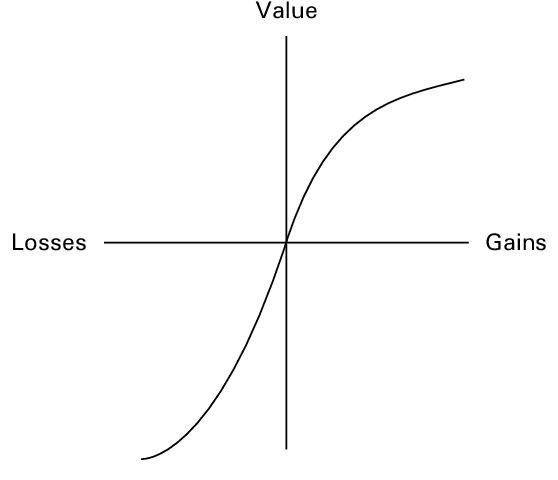

In the original article on Prospect Theory, Kahneman & Tversky showed that first, how we think about value is not absolute, but typically how it varies from a given reference point. It was revolutionary to suggest that we make decisions about risk theorizing that in the experiments, subjects “experience” losses more vividly than we do gains—in fact, that we experience losses about 2.5X as dramatically as we do gains. (That would suggest we experience a 10% loss with the same negative emotion that we experience a 25% gain’s positive emotion). Further, as the chart below suggests, we get deep negative value from a little loss, whereas it takes a big gain to experience that much emotion on the upside. Thus…loss aversion. Turns out we behave such that we are much more motivated in our decision-making to avoid losses more than we are at achieving gains. Hmmm…not much homo economicus about that, is there?

While I only met Danny Kahneman once (and had a couple of email exchanges with him), I could see that he had an almost childlike curiosity about the world, about people, and about how they went about making decisions. He was the definition of the “beginners mind” and he did it well. His success, including being the only psychologist to win the Nobel Prize in Economics, didn’t seem to result in more confidence in applying behavioral economics widely, or even, to his own decisions. He ruefully would remark that studying the behavior of how people incorrectly make decisions didn’t seem to result in less of it by him! He would frequently point out that he distrusted your intuition, and he distrusted his own intuition even more.

The significance of behavioral economics is still debated—in academia. But at Bigelow? It is not debated at all. EOMs benefit greatly from understanding the cognitive biases they are subject to (with skin in the game) when for example, they are negotiating with investors (with no skin in the game and therefore no biases). The practical application of Behavioral Economics as practiced by Kahneman may not overcome all the weaknesses of traditional economics, or always be illuminating for the “why” someone made the decision they did but…it shows the errors of applying classical economics blindly (as most still do) and gave us a framework for understanding the “why’s” behind certain EOMs revealed preferences (behavior).

Moreover, Kahneman's distinction between the "experiencing self" and the "remembering self" provided me with a new understanding of our EOM client’s perspective on satisfaction and happiness. Understanding that their perceptions of their financial well-being are influenced not only by their current experiences but also by their memories of past experiences allowing us to tailor our advisory approach to focus not just on financial outcomes but also on creating positive memories associated with their financial decisions.

By understanding the complexities of human decision-making and incorporating behavioral insights into our practice at Bigelow, we have been able to better serve our EOM clients and help them achieve their financial goals while navigating the biases and irrationalities inherent in the decision-making process.