2 minute read

Santa Barbara, California

As one who works exclusively with Entrepreneur Owner-Managers (EOMs) (40 years and counting), I find that most private business owners are curiously unaware of the power shift that has taken place in the private transaction market over the last forty years. In the private market the balance of power has shifted from those with the capital (who used to have the power) to those who own the high performing private businesses.

Why the shift? Several reasons, but the overarching driver is the abundance—no, the superabundance—of capital in our world today flowing into the private market, and into private companies. Most are unaware that there are literally thousands and thousands of potential investors worldwide who have discovered that the private company market is the best place to allocate capital. This superabundance of capital combined with the EOM’s superior performing niche enterprise means that when we want to capture a capital gain, it’s all good news for us.

In plain Latin, Nullius in verba.

What?

Nullius in verba is Latin for "on the word of no one" or "take nobody's word for it" and is the motto of the Royal Society. The Founders of the Royal Society chose the motto soon after the Society's founding in 1660. Like all high-performing EOMs we are also independent critical thinkers, with no need to conform, even a bit contrarian, where opinions and narrative fallacies are a dime a dozen. Why should we take anyone’s word for it when we can seek the data?

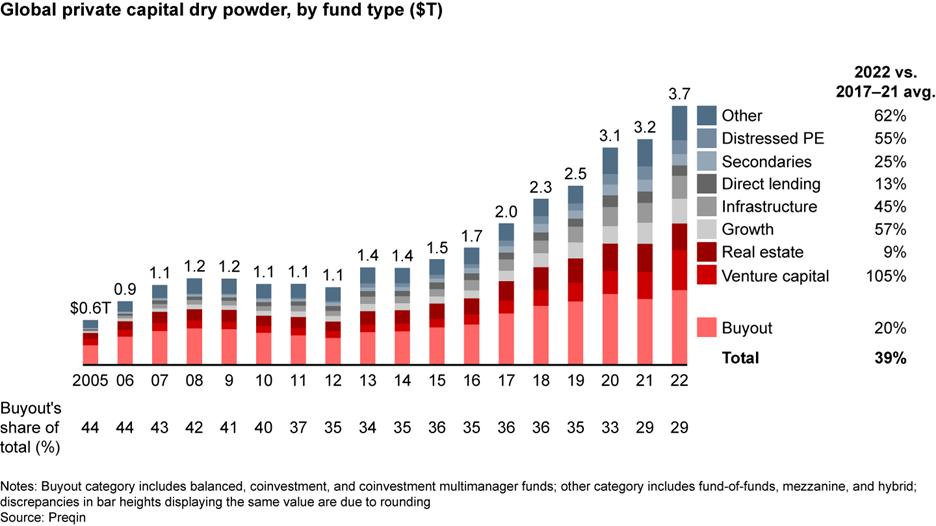

So, what is the data on the power shift from investor to EOM? Over the past twenty-five years there is a marked shift in investors’ preferences—from public markets to private markets mostly through investment in Leveraged Buyout and Venture Capital funds. The difference between them is largely due to the maturity of the investment—i.e., Venture investments usually have some unresolved product or market risk at their earlier stage, whereas Leveraged Buyout investments are almost always in mature businesses with significant positive cash flow. The general public and mass media imprecisely refers to both of these categories as Private Equity which muddies the conversation. Regardless, the change in where investors are allocating capital has had massive reverberations for EOM private business owners. What are the major drivers that have resulted in the private market becoming one of an abundance of capital instead of a model of scarcity of capital that has been traditionally used?

- In the last few decades, the largest institutional investors like pension funds and endowments have increased liabilities (as more people retire from earning and are planning to live longer in retirement), and decreased ability to earn returns from most other asset classes. They are seeking increased returns which they find in the private market.

- There are about 3,600 public companies in the U.S. today, about one-half as many as there were in 1996. (The total market capitalization is much higher—3.5X higher today, but the number of companies that are public is half). The drop reflects high M&A activity and a low level of initial public offerings (IPOs). More than 90% of the stocks that have disappeared since 1996 were those of small- and micro-capitalization companies.

- In recent decades, sophisticated investors, especially institutions, have changed their asset allocation towards private markets to seek higher returns. The celebrated David Swenson (the innovative and charming Chief Investment Officer of Yale’s endowment) authored a popular book called Pioneering Portfolio Management (2009) outlining his approach to allocating more assets to the private market. When Swensen took leadership of the Yale endowment in the mid 1980s, 65% of the portfolio was U.S. large public equity, 15% to bonds, and none to private equity. Today, about 65% is allocated to private equity.

- Because Leveraged Buyout Funds and Venture Capital firms are private and largely unregulated (compared to the highly-regulated public markets), their reporting is not transparent nor particularly comparable. Challenging, but if we take my Mr. Simple “crayon” approach to returns, we can say that according to the World Economic Forum in a white paper called The Evolution of the Private Equity Industry (August 2022), for the twenty-years through 2020, the S&P 500 Index had a total return of 8.9%, while Private Equity as a class had a 14.9% total return in the aggregate and on average. But, this may be a case where averages obscure critical thinking because the variation around the mean is massive. It is well known that the returns by institutional investors in the private market are highly variable depending upon the Firm, which Fund in the Firm, the generation or vintage year of the Fund, and among other things…luck. These investments are also customarily illiquid for a long period of time, frequently ten years or more.

- Prequin, a firm that gathers data on the Private Equity Industry concludes that Private Equity has $3.7 Trillion of capital committed but as yet uninvested. That’s not counting leverage from bank debt which usually runs in the 50% of purchase price range. These funds are invested typically in Limited Partnerships that have a ten-year life.

All these facts tell me the Superabundance of capital in the private market is not a short term phenomena, but that a structural change has taken place. While recessions will come and go every few years, inflation may go up and go down, interest rates rise and fall, the number of investors chasing great private companies has never been higher—and this may be just the tip of the iceberg.

What I am Reading / Listening to

Meditations

By Marcus Aurelius

Contributed by Mari Lister

Meditations is a series of personal writings by Marcus Aurelius, Roman Emperor 161–180 CE, setting forth his ideas on Stoic philosophy. These were private notes to himself for his own source of guidance and self-improvement. He strongly believed in the importance of analyzing the judgement you have of yourself and of others.

I have loved Meditations since I first stumbled upon it in my father’s library many years ago. I fell back in love with it during a summer spent in upstate New York studying philosophy. I then reconnected with this book again after having children and a family…it has adapted with me and will continue to. It is not an easy read but well worth the insights you may garner from getting through it.

Entrepreneur Owner-Manager Quote

"Since founding TAG, my brother Terry and I have supported our employees, our customers, and our suppliers as partners. As we sought to find a growth investor, we wanted that same partnership approach; a group that understood the nuances of our business model, industry, customers, and individual desires. Center Rock brings all these qualities and more.”

-Gary Wilt, President & Co-Founder of TAG Manufacturing, Inc.