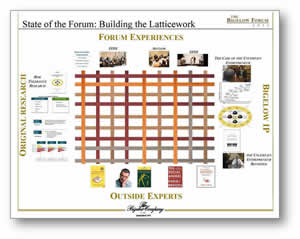

The year 2012 marked the fifth year of The Annual Bigelow Forum, a gathering of entrepreneur owner-managers and their expert advisors. Robert E. MacLeod, a Bigelow Managing Director, gave an overview on the “State of the Forum” and provided a high-level explanation of the way Forum thought leadership, original research, relationship building experiences, and provocative outside experts from the previous four years have built a latticework of exclusive Forum content.

Peter R. Worrell, a Bigelow Managing Director, gave an overview of the compelling preliminary results of the Bigelow-Kennedy School joint research on the risk tolerance of entrepreneurs as compared to their expert advisors—the only research of its kind we are aware of. The study examined the risk tolerance of Entrepreneur Owner-Managers and their expert advisors by using a complex real life business scenario that involved “risky” decisions and nominal monetary outcomes. Three surprising key findings included:

- Owner-managers acting as Principals (for their own account) are far too risk averse when attempting to make a decision that will lead to an optimal outcome. In fact, to say that owner-managers were risk averse seriously understates the case, which is surprising because it is in direct contradiction to the media and general public’s view of entrepreneurs as risk takers.

- Expert advisors acting as Principals (rather than as Agents) behaved no differently in this research than Entrepreneur Owner-Managers. This was in accordance with our hypothesis.

- Probably the most controversial and potentially most troubling finding is that advisors acting as Agents (for their client’s best interest) did not evidence any objectivity. They displayed exactly the same risk aversion as the owner-managers, suggesting they are subject to the same cognitive biases as their clients, even when they are deemed to be disinterested and coldly objective!

This may have broad implications for how expert advisors can be most effective, and deserves additional research.

Worrell then introduced The 2012 Bigelow Forum Featured Speaker, Dr. Atul Gawande. Dr. Gawande is a surgeon at Boston’s Brigham and Women’s Hospital, the author of three bestselling books, and a staff writer at The New Yorker. He typically uses his perspective as a doctor who performs complicated, high-risk surgeries to explore performance challenges that affect all professions. Dr. Gawande’s talk focused on the issue of complexity in our culture, highlighting how today’s complex systems require moving from rugged individualism to unique systems or collaborative groups for success. He described how many professionals still work as cowboys, when what we really need are more pit crews.

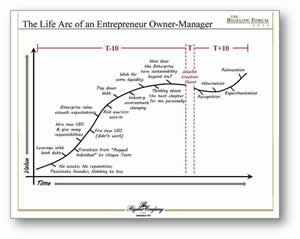

The next day’s sessions focused on real life case studies of owner-managers. We examined the ten years leading up to a wealth creation transaction (what we call T-10) and the ten years after a wealth creation transaction (T+10), as captured in the life arc of the Entrepreneur Owner-Manager, a piece of Intellectual Property which has been used at previous Forums.

The T-10 Discussion

In the first session, we heard from a recent Bigelow client, Bill Purington, President & CEO of Maine Drilling & Blasting, a family owned and operated business. David C. Linton, a Managing Director at Bigelow, conducted a one-on-one interview with Bill about his journey along the life arc as he prepared for his wealth creation event. Bill candidly shared his experience with the audience, including his use of advisory boards, the formation of an ESOP, and the role of advisors to help assist a dysfunctional family-run business all while asking, “If we are going to have a capital gain some day, then what are the things we should be doing right now?” These same topics were then explored by smaller participant-led breakout groups who “reported out” their group’s findings.

The T+10 Discussion

The second session of the morning focused on a panel of owner-managers in the T+10 stage of the life arc. The five panelists, Todd Baldree, former CEO of Level One (T+2), Peter Getman, founder of MicroArts (T+10), Ford Reiche, founder of Safe Handling, Inc. (T+3), Andrew Schonbek, former CEO of Schonbek Worldwide Lighting (T+5), and Rolf Turnquist of Turnquist Paper Company (T+15), shared their personal and family experiences post-transaction, and spoke from the heart about where they currently see themselves within the four post-transaction stages (Recognition, Hibernation, Experimentation, Reinvention). Worrell moderated the panel, asking them whether they were well prepared for the systematic stages post transaction; what challenges they and their families were surprised by after their wealth creation event; and what pearl of wisdom they would share with the group when reflecting on the phrase, “If I’d only known then what I know now.” There was a spirited discussion on the need for wealth management professionals who understand not only the rational, but the emotional sides of owner-managers.

The closing remarks for The 2012 Bigelow Forum built on the latticework introduced the previous day and furthered our collective understanding of these unique and often challenging Entrepreneur Owner-Managers.