Overview

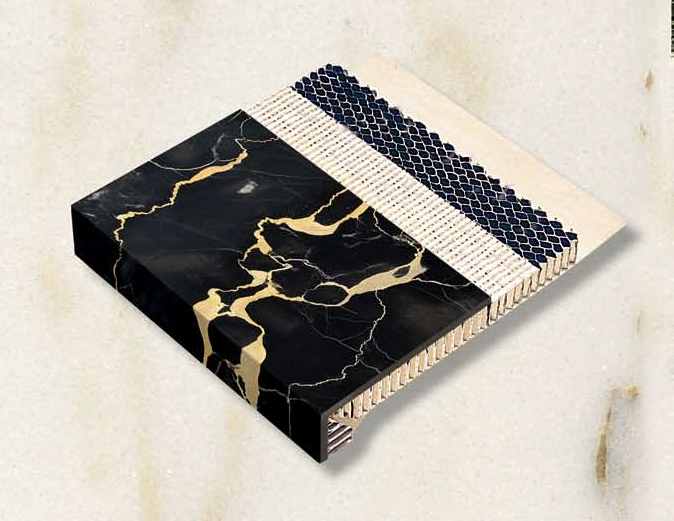

Stone Panels, Inc. (“Stone Panels” or the “Company”) manufactures a proprietary wall cladding system of high quality, natural stone lite-weight composite panels and stone veneers. It is a world leader in design and innovation for commercial construction applications throughout North America, Europe and the Pacific Rim.

Bigelow Assignment

To proactively seek out the best next majority owner for the Company that would satisfy the personal objectives of the existing majority shareholder, transition management leadership, and continue to invest in the Company’s successful market and product expansion plans.

Challenges

The commercial construction industry was off from its peak by over 50%, yet Stone Panels had more than doubled its business over that period.

The growth story was dependent on finding an investor who believed in the conversion opportunity to replace the use of heavy dimensional stone facades with a lower installed cost stone cladding system. Furthermore, Stone Panels was a material supplier to construction projects with long sales cycles and a wide range of project values, from $100 thousand to over $5 million.

Could Bigelow find an investor that was bullish on the long term future of commercial construction? Could Bigelow find an investor that had experience with stone manufacturing and innovating new technologies in a 2,000 year old industry? Could Bigelow achieve a high-water-mark valuation that validated the differentiated business model, while preserving the qualitative objectives of the management team to continue on its growth plan?

“Stone Panels marks the tenth transaction between Metapoint Partners and Bigelow over a 20 year relationship. Does anything else need to be said?” Keith Shaughnessy, Chairman and Chief Executive Officer Metapoint Partners, LP

“Bigelow put tremendous effort behind helping us find the best next investor, which was a tall order after our terrific experience with Metapoint.” Tim Friedel, President and Chief Executive Officer Stone Panels, Inc.

Outcome

Bigelow created a market for Stone Panels using its proprietary methodology that resulted in numerous strategic, financial, and private equity backed platform investors expressing high interest in investing in Stone Panels.

The Company selected Thompson Street Capital Partners, a St. Louis-based private equity firm, who had partnered with a solid-surface building products executive that was looking for a hands-on board role. The transaction was closed without any third-party debt financing in place at closing, allowing for higher surety of closing, reduced demands on the Management Team during due diligence, and an expedited closing process. The end result was a great value for the exiting shareholders and a new investor for Stone Panels that provides the Company with capital for growth, as well as deep experience in growing project-based, building product businesses.