Entrepreneur Owner-Manager Background

When John Fallona was mid-career as a Senior Manager at Central Maine Power (“CMP”), a publicly owned electric utility serving most of Maine, he never gave a serious thought to owning his own business. Why would he? He loved what he did at CMP. It was a group of collegial professionals in a small geography who knew their profession and each other incredibly well. He had already invested 25+ years at CMP, was promoted through the ranks, lived in Gardiner, ME, and really enjoyed the industry as well as the trust and the responsibility for providing light and power to his neighbors.

When CMP’s Board of Directors made the decision to sell its underground utility locating and construction services business, they turned to John to do so. What he found was not just little interest, but no interest – investors were not interested in the combined businesses of locating and construction services. When he talked amongst his long-term coworkers, they floated the idea that John might buy the division. He certainly had the knowledge and experience in the operational aspects of the business. The bigger question was whether John would want to become an entrepreneur at a point when his horizon was showing retirement, not business ownership. But if John didn’t buy the business from CMP, what would happen to the employees who had been with that division?

John decided that the idea had merits and the benefits outweighed the risks. New to the Entrepreneur Owner-Manager game, he reached out to some experienced advisors and with their help, he invested with a partner and with CMP as a cooperative seller, acquired the division which was called On Target. John quickly realized he needed to move On Target physically and culturally. He wanted to make a clean break with the traditional large utility mindset, shift his team into an entrepreneurial mindset, and begin to expand the business (and payoff the debt).

He recruited his son Mike into the business, developed the management team and a couple of decades later, they had built the business into a successful regional firm. Mike became the President of On Target and while John still worked on strategy, the day to day running of the company fell on Mike.

John designed his estate planning to move some of the economic value of the company from himself to his children, Mike, Cathie and Karen. In doing so, On Target truly became a family business.

Challenges

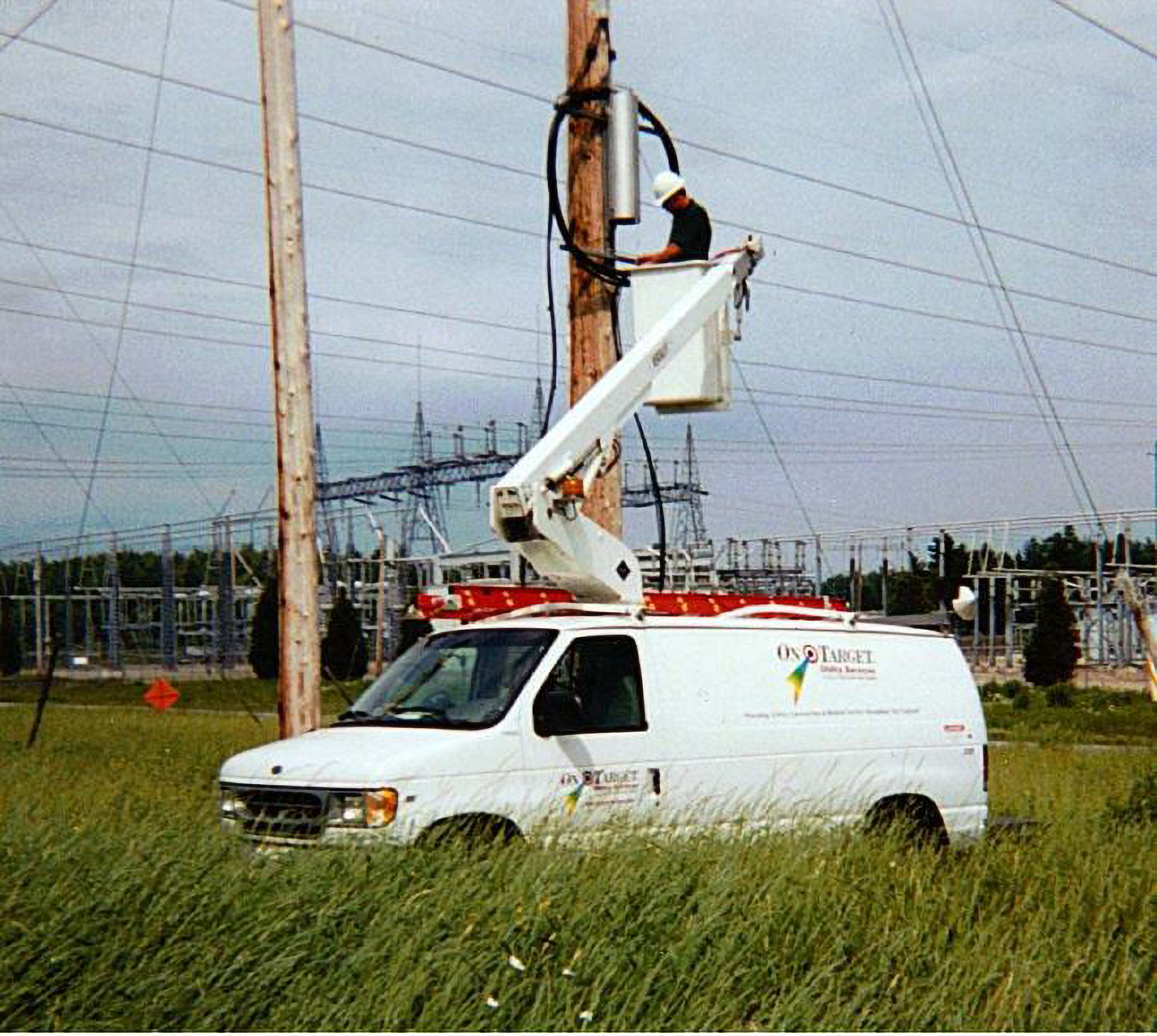

As noted, On Target had two separate operating divisions that made up the company: an undergound utility locating services business and construction services group that provided pole setting, storm restoration, and power line services for utility customers. On Target was the major player in New England on the locating side of the business, doing 2 million locates a year, but large national competitors were starting to arrive at the New England border. Meanwhile, because of its stellar reputation, the construction services group which was more locally focused in Maine was being asked to do work all over New England and increasingly outside of the region.

John and Mike viewed their two lines of business as separate entities and faced the reality that though they dominated the New England market for locating, both the numbers of customers and competitors in the locating business were consolidating. Could they keep the large locating competitors from encroaching on their dominant position in New England while at the same time providing the construction services group with the resources it needed to grow beyond Maine? How should they view their two lines of business? Did John want to stay an entrepreneur or finally reach the retirement horizon? Mike was also ready for a change, with an itch that needed to be scratched in the pursuit of executive education. How did Mike’s sisters, also owners, feel about the company? What time was it for On Target? What time was it for the Fallona family?

“On Target has grown to be the largest locating and utilities services business in Northern New England. By joining forces with the industry leader, we have ensured our employees’ continued success. ” John Fallona, Chief Executive Officer On Target Utility Services

“The experience of working with you each individually and collectively as a team has been one of the most rewarding of my professional life and from a family perspective we are very grateful to have had that opportunity.” Mike Fallona, President On Target Utility Services

Bigelow Relationship

Facing some decisions in the marketplace and the boardroom the four Shareholders, John, Mike, Cathie and Karen, and their families began thinking about ownership transition in the company. John met with his long-time corporate attorney to get his counsel. Both John and Mike read Enterprise Value with the immediate reaction being “I wish I’d read this a few years ago.”

They began a three-month dialogue with Bigelow about understanding and evaluating their strategic alternatives. Could they find a way to position the two separate business lines into an attractive package for a buyer who viewed the two together as a positive rather than a negative? What would the impact be on John as the Founder, and Mike as the President, in either alternative? Should they sell one division, and keep the other? Engaging with Bigelow to seek the best new majority owner for On Target helped them work through their myriad of questions and alternatives and choose the path that would lead to the best outcome for the entire Fallona family, its employees, as well as the next investor.

Outcome

In the time since John tried to market the business when it was owned by CMP, the locating industry had consolidated significantly. Large national locating players with significant geographical reach were now looking to add additional high-value services to their offering. The company’s positioning as the dominant locating player in the Northeast coupled with its fast-growing construction services group and domain-experienced management team meant that multiple investors were attracted to the opportunity to acquire the entire business – locating and construction services. Ultimately, the Fallonas chose US Infrastructure Group (USIC), an Indianapolis based strategic acquirer which is itself an investment of Partners Group AG, a Swiss-based private equity group.

Joining forces with USIC, which performs 70 million locates around the country, has solidified On Target’s position as the dominant locating business in New England. Furthermore, USIC is providing the resources to expand its construction services group both within and beyond New England. The transaction meant that Mike Fallona was freed to engage in an entrepreneurial executive education program at Oxford University in England and John Fallona could finally retire with the peace of mind that his company would still have an impact locally throughout the region, providing jobs and critical services to his friends and neighbors.