Overview

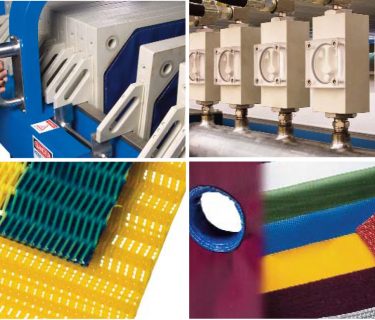

Micronics is a leading global designer and manufacturer of engineered industrial solid-liquid filtration equipment and related aftermarket consumables: filter cloth, OEM filter press plates, and spare parts. The Company manufactures in both North America and the UK, and sells to mining, chemical, wastewater, food & beverage, and industrial end-market customers worldwide. The Company is the only global industry participant that offers an integrated equipment and aftermarket consumable product strategy to the filter press industry.

Bigelow Assignment

The founder / CEO desired to proactively seek out the best new majority investor which would allow him to monetize a significant portion of his investment, and responsibly transition the business to ensure its sustainability and continued success. The Company was at an inflection point in its growth trajectory, which required skills to supplement the founder’s unique ability in filter press applications know how.

Challenges

Could Bigelow find an investor that would fully appreciate the unique positioning of Micronics in the filter press industry? Would the rapidly improved financial performance be considered sustainable? Would investors value a strategic focus on the highly cyclical mining end-market? Would an investor be willing to help transition the founder / CEO’s responsibilities to a new COO over a short period? Would an investor support moving the assembly operation to a new larger facility?

“I’m a successful businessman and I consider myself to be on top of my game. I now shudder to say it, but can you believe I actually considered having no M&A Advisor at all? Thank goodness I found Bigelow because I simply had no idea of the complexity involved with making this happen successfully. Bigelow did an outstanding job; we could not have selected a better team.” Barry Hibble, Founder & CEO Micronics, Inc.

“Bigelow did an amazing job. You brought the stockholders great value and you deserve all the credit in the world for that.” Jeffrey P. Seifert, Senior Vice President TD Bank, N.A.

Outcome

Bigelow’s global reach for the highest quality strategic and private equity group (PEG) investors asked the question, “Is it already in your business plan to be in solid liquid filtration and do you value a differentiated strategy that focuses first on aftermarket consumables, but also values a significant capital equipment business?”

The founder was able to select the best fit PEG, Vance Street Capital LLC (Los Angeles, CA) that highly valued engineered products and services and had been searching for the right filtration platform investment for years.

The transaction was structured in a manner that allowed the key non-owner management team members to benefit financially from the successful transaction as well as enabling them to become significant equity owners in the recapitalized Company.

By partnering with Vance Street, Micronics was able to transition 85% of the ownership from the founder and at the same time, accelerate the key strategic moves required to capitalize on the tremendous market opportunity.